Loans are processed by the Student Entitlement Management Engine (StEME), which is the part of TCSI responsible for the following:

- Creating student loans.

- Calculating student HELP loan balances.

- Checking student HELP loan balances against previous, pending, and new loans.

- Updating loan data that has been sent from Submissions.

- Maintaining loan statuses so that you can track loan progression.

- Sending loans to the ATO.

- Adjusting student HELP loan balances when loan repayment data is sent from the ATO.

Loan details in Submissions can be found in the Unit enrolment data group.

HEP loans processing

When the unit enrolment packet is submitted, StEME creates the loan only if all additional details are provided as follows:

- An E448 CHESSN on the Students record linked to the loan application, or enough information on the linked student record to issue a CHESSN for the student.

- An E490 Student status code that indicates that the student will access a HECS-HELP loan, FEE-HELP loan, or VSL.

- An E558 HELP loan amount with a value greater than 0.

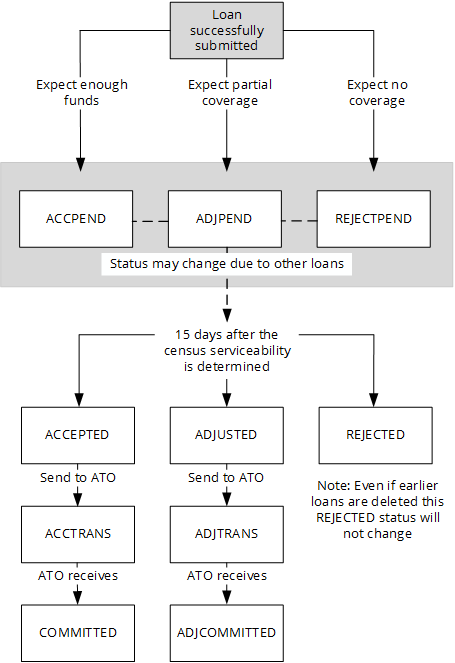

Once StEME has created the loan, it checks that the E558 HELP loan amount does not exceed the student’s HELP loan balance by determining the serviceability of the loan based on the student's previous loans and other pending loans. The student's HELP loan balance is allocated to the student's loans in order of precedence, starting with the loan with the earliest census date. Loans that have the same census date are put in the order they were created or last amended. Based on whether the student's Lifetime entitlement has enough money remaining to service the loan, the status is set as follows:

- ACCPEND status (pending acceptance) if the student's HELP loan balance is expected to cover the loan.

- ADJPEND status (partial coverage) if the student's HELP loan balance is expected to partially cover the loan.

- REJECTPEND status (pending rejection) if the student's HELP loan balance is not expected to cover the loan.

The loan serviceability is finally determined 15 days after the census date for the unit of study, when the loan status is set as follows:

- ACCEPTED status if the student's HELP loan balance covers the loan.

- ADJUSTED status if the student's HELP loan balance partially covers the loan.

- REJECTED status if the student's HELP loan balance does not cover the loan.

Loans with an ACCEPTED status or ADJUSTED status that have an E416 Tax file number on the linked Students record are then sent to the ATO when the loan status is set as follows:

- ACCTRANS status (accepted in transit) if the loan amount is accepted by the ATO as it is reported.

- ADJTRANS status (adjusted in transit) if the loan amount is adjusted before it is sent to the ATO.

The ATO then acknowledges that they have received the loan by changing to COMMITTED status for loans that were accepted, or ADJCOMMITTED status (adjusted committed) for loans that were adjusted.

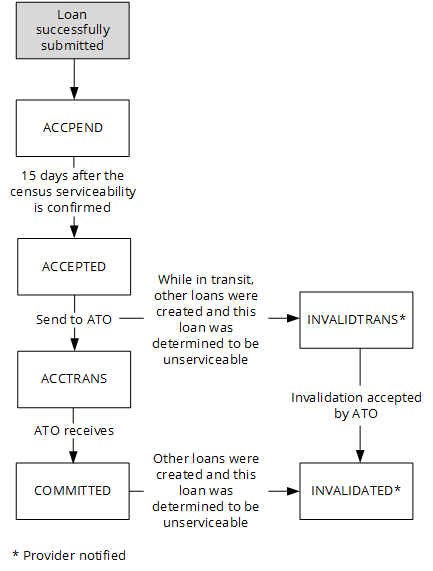

The diagram Loan processing workflow illustrates the loan status changes in the processing of a student loan.

Loan processing changes can be tracked by viewing the E490 Student status code in the Unit enrolment record. Note that the E490 Student status code may also change if the student’s enrolment status changes.

Repayments

StEME receives loan repayment details from the ATO on a monthly basis, and the serviceability of all loans with a census date on or after the day the repayment details are received is reassessed. At this point loans with a REJECTPEND status may be upgraded to ACCPEND status or ADJPEND status, and loans with an ADJPEND status may be upgraded to ACCPEND status.

Deletion

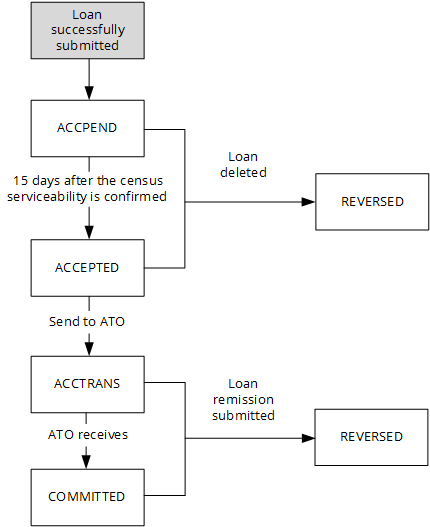

StEME deletes the loan if any of the following changes are made:

- E490 Student status code has been successfully changed to a code where the student does not require a loan.

- E558 HELP loan amount has been set to 0.

- The linked Unit enrolment record has been deleted.

When a loan deletion has been successfully submitted, the loan status is set as follows:

- DELETED status if the loan is not sent to the ATO before StEME receives the deletion request.

- REVERSED status if the loan has been sent to the ATO before StEME receives the deletion request. The ATO is advised of the deletion.

When a loan is deleted, StEME reassesses the serviceability of all pending loans with a lower precedence.

The image Loan deletion illustrates the statuses where a serviceable loan is deleted.

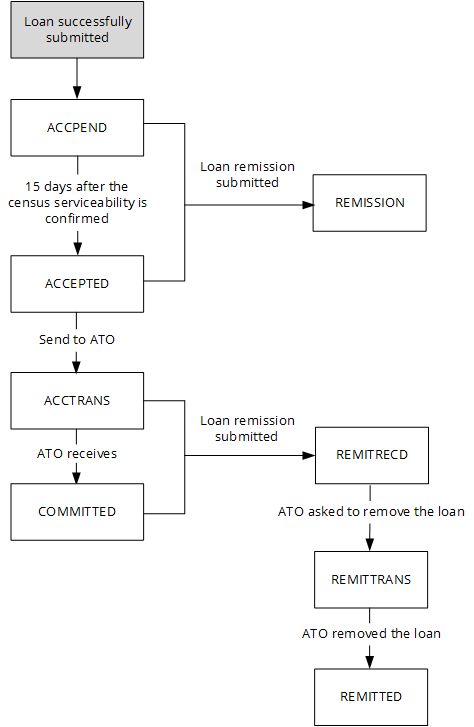

Remission

StEME remits the loan when a value for E446 Remission reason code is successfully submitted. When a loan remission has been successfully submitted, the loan status is set as follows:

- REMISSION status if the loan is not sent to the ATO before StEME receives the remission request.

- REMITTED status if the loan has been sent to the ATO before StEME receives the remission request. The ATO is advised of the remission.

When a value for E446 Remission reason code is successfully submitted, StEME reassesses the serviceability of pending loans with a lower precedence.

The image Loan remission illustrates the statuses where a serviceable loan is remitted.

Invalidation

The loan can become invalid when new loans are later submitted for the student that make the loan unserviceable. When a new loan is submitted for a student, StEME reassesses the serviceability of the new loan and all pending loans with a lower precedence, and the student's HELP loan balance allocation is adjusted. Loans with a lower precedence may therefore become partially unserviceable or fully unserviceable as a result of the student's HELP loan balance reallocation.

When a loan becomes invalidated, the loan status is set as follows:

- INVALIDTRANS status (invalidated in transit) if the loan is not sent to the ATO before it is invalidated.

- INVALIDATED if the loan has been sent to the ATO before it is invalidated. The ATO is advised of the invalidation.

The image Loan invalidation illustrates the statuses where a serviceable loan is made invalid.

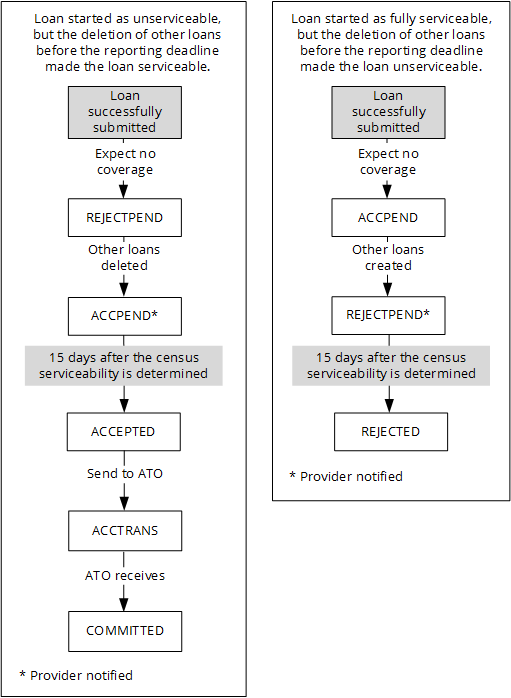

The image Loan serviceability illustrates the statuses of serviceable loans for a student that are impacted by the submissions of new loans, and the statuses of unserviceable loans for a student that are impacted by the deletion of loans with a higher precedence.

Notifications

Notifications generated by StEME are sent to Submissions when there is a change to a loan. Some example notifications are as follows:

- The loan status is downgraded, such as when the loan status is changed to ADJPEND status, REJECTPEND status or INVALIDATED status.

- The loan status is upgraded, such as when the loan status is changed from REJECTPEND status to ADJPEND status, or from ADJPEND status to ACCPEND status.

- The E490 Student status code has been successfully changed to a code where the student does not require a loan.

- The loan has been deleted because E558 HELP loan amount has been set to 0.

- The loan is deleted because the linked Unit enrolment record has been deleted.

- The loan is remitted.

If the status of a loan is retrieved in Submissions, any notifications about the loan status are deleted from the notification table.

Notifications are not received when a loan moves through the normal loan lifecycle, such as when the loan status is changed from ACCPEND status to ACCEPTED status. Notifications are also not received when changes to the loan status are made in Submissions, such as when the loan status is changed from ACCEPTED status to REMITTED status.

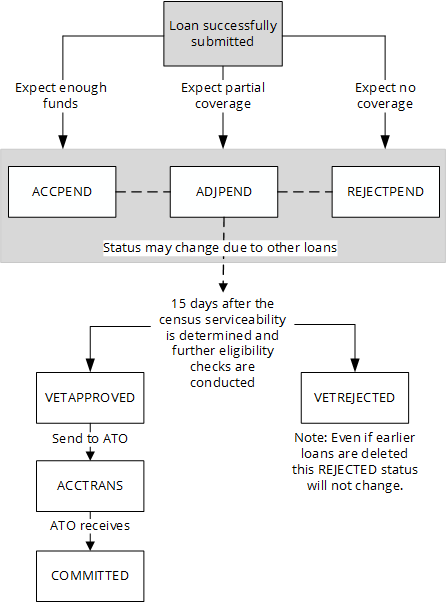

VET loans processing

StEME processes VSL in the same way as HEP loans except that VSL with a status of ACCPEND status, ADJPEND status or REJECTPEND status are not automatically changed to ACCEPTED status, ADJUSTED status, or REJECTED status 15 days after the census date for the unit of study. Further eligibility checks, such as VSL course loan limit checks, are carried out on VSL loans and once the additional checks are completed the loans status is set as follows:

- VETAPPROVED status if the loan passes all eligibility checks.

- VETREJECTED status if the loan does not pass all eligibility checks.

The image VSL processing workflow illustrates the loan status changes in the processing of a VSL.